Recent geopolitical events have significantly impacted energy prices, particularly natural gas, affecting both businesses and individuals. Wholesale gas prices have spiked, reaching €345 per MWh—over ten times the average since 2014. Although wholesale prices have decreased as of April 2024, consumer gas bills in France remain high due to increased taxes, notably the Internal Tax on Natural Gas Consumption (TICGN).

This article aims to provide a comprehensive understanding of natural gas management in France, from extraction to supply, and to explain the components of a gas bill, including taxes and the entities compensated through it.

From Extraction to Supply: The Natural Gas Chain

Natural gas, used for heating, cooking, and hot water, originates from underground reservoirs and passes through a complex network of actors and operators to reach consumers.

Exploration and Production

Natural gas forms over millions of years from organic matter in geological formations, primarily consisting of methane.Energisme+1Energisme+1

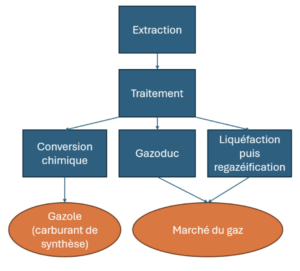

Production involves two main steps:

<

-

- Extraction: Retrieving gas from permeable underground layers.

- Purification: Removing non-combustible by-products like nitrogen and helium to maximize calorific value. Some extracted components are valuable and used in petrochemistry.

Currently, over two-thirds of natural gas resources are located in Russia and the Middle East.

Source : Tout savoir sur le gaz naturel | IFPEN (ifpenergiesnouvelles.fr)

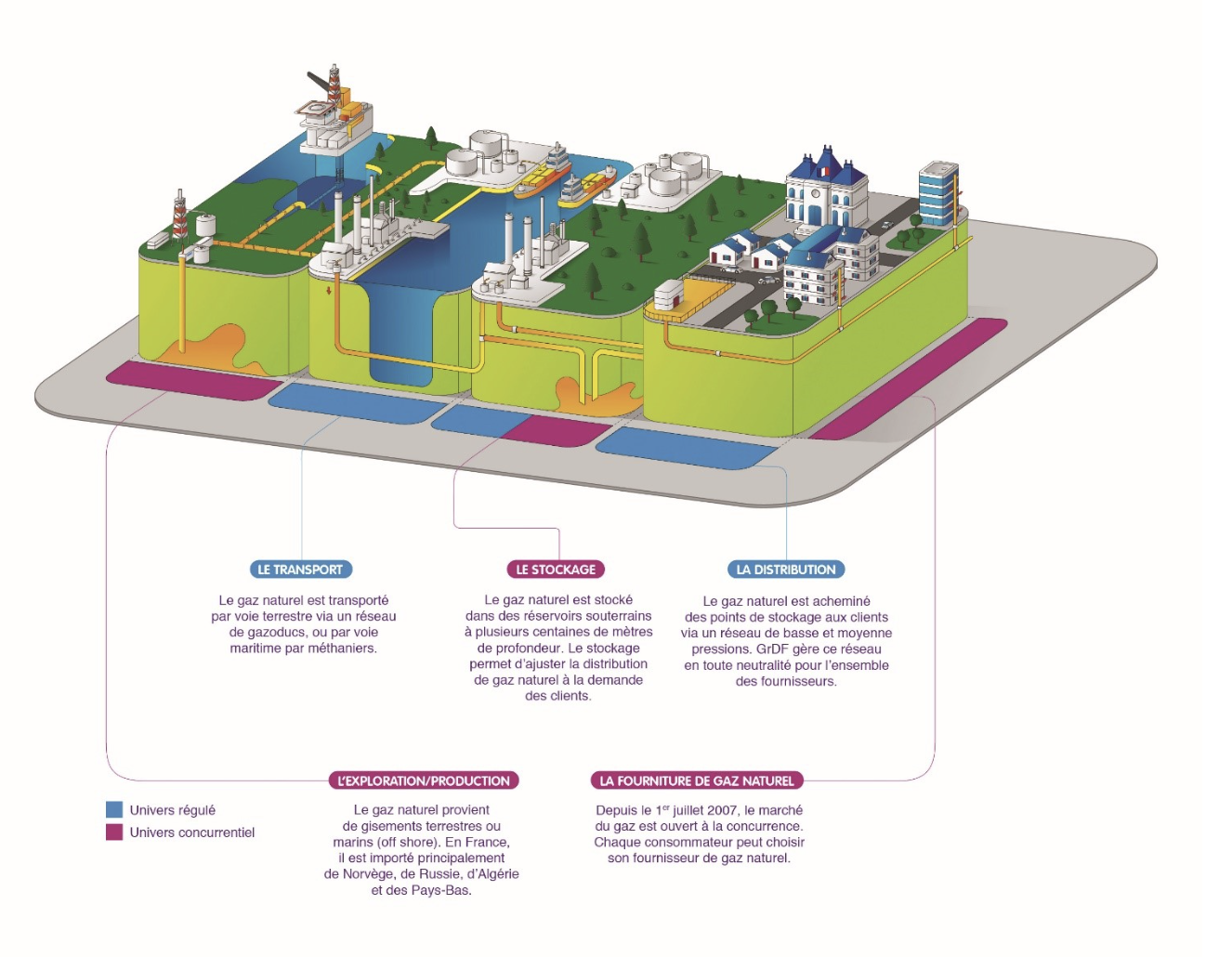

Transport and Distribution

Transport

Due to its low density, natural gas is transported via:

- Pipelines (Gazoducs): Compressing gas every 100–150 km to move it through high-pressure pipelines, either buried or surface-laid, depending on the terrain.

- Liquefied Natural Gas (LNG) Carriers (Méthaniers): Transporting liquefied gas when pipelines are impractical due to distance or geopolitical issues. France has four LNG terminals: Dunkirk, Montoir-de-Bretagne, and two in Fos-sur-Mer.

Before entering the distribution network, gas is odorized with mercaptan for safety, as natural gas is odorless.

Source : Gazoduc — Wikipédia (wikipedia.org)

Source : Méthanier — Wikipédia (wikipedia.org)

Distribution

In France, 26 distribution network operators (GRDs) manage gas distribution, with GRDF covering 95% of the territory. Sites are classified from T1 to T4 based on their Annual Reference Consumption (CAR).

Source : Extraction-production, transport et distribution du gaz naturel | GRDF Cegibat

Supply

Natural gas primarily serves heating and cooking needs. For professionals, heating accounts for about 50% of office energy consumption.

Since December 31, 2020, regulated gas tariffs (TRV) have been abolished for professionals, and as of 2023, for individuals as well, to comply with EU directives promoting market competition.

Approximately 4% of the territory is served by Local Distribution Companies (ELDs) like Gaz de Bordeaux or Gaz et Électricité de Grenoble (GEG). Alternative suppliers also contribute to market competition.

Unlike electricity, gas pricing in France lacks a uniform péréquation principle; prices vary based on the distance from the network, categorized into six tariff zones, with Zone 1 being the least expensive and Zone 6 the most.

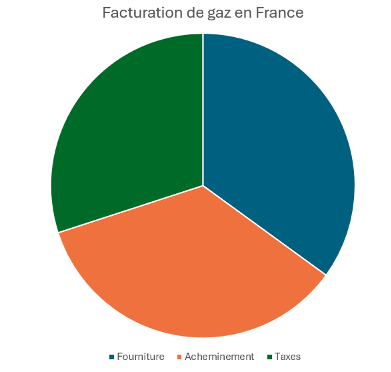

Breaking Down Your Gas Bill

A gas bill comprises three main components:

- Supply: Approximately 35%

- Transportation and Distribution (Delivery): Approximately 35%

- Taxes: Approximately 30%

Supply

This includes:

-

- Fixed Charges: Subscription fees, varying based on usage.

- Variable Charges: Based on the volume of gas consumed during the billing period

For example, the 2024 reference sales price in the GRDF zone is set by the Energy Regulatory Commission (CRE)

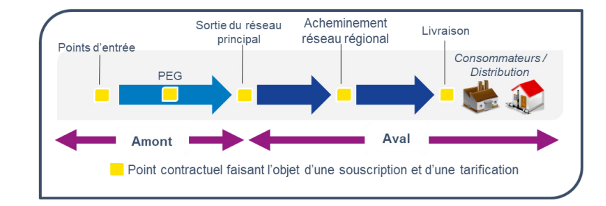

Transportation and Distribution

These costs cover the use, maintenance, and modernization of the gas transport and distribution networks:

-

-

- ATRT (Access to Transport Network Tariff): Regulated fees for using the transport network, operated by GRTgaz and Teréga.

- ATRD (Access to Distribution Network Tariff): Fees for using the distribution network, managed by GRDF or ELDs.

-

Key terms include:

-

-

- TCS (Exit Capacity Term): Costs for transferring gas from the main to regional networks.

- TCR (Regional Transport Capacity Term): Costs for transporting gas within regional networks.

- TCL (Delivery Capacity Term): Costs based on the delivery capacity subscribed for a meter.

- TFL (Fixed Delivery Term): Annual fixed charges related to delivery points.

-

Taxes and Contributions

Several taxes apply to gas bills:

-

-

- TICGN (Internal Tax on Natural Gas Consumption): Aimed at reducing fossil fuel dependence; increased from €8.37/MWh in 2023 to €16.37/MWh in 2024.

- CTA (Tariff Contribution for Gas Transmission): Funds pensions for employees of the electricity and gas industries.

- VAT (Value-Added Tax): 5.5% on subscriptions and 20% on consumption and TICGN.

-

Strategies to Reduce Your Gas Bill

-

-

- <

- Analyze Consumption: Use energy management systems (EMS) to identify high-consumption areas and implement efficiency measures.

-

Compare Suppliers and Contracts: Evaluate fixed vs. indexed price offers to find the most cost-effective option.

TICGN Exemptions for Professionals: Possible for specific uses like electricity production or certain industrial processes; requires submitting form Cerfa No. 13714*04 annually.

- Optimize Delivery Charges: High-consumption sites (>100 GWh/year) in competitive sectors may qualify for up to 90% reduction in delivery tariffs.