- Revenues of €3.46 million, up 71% from 2020

- Signed ARR(4) of €5M by the end of 2021

- Results that integrate the intensification of the commercial conquest efforts as well as the technological investments of the Loamics platform

Performance Q1 2022

- Acceleration of the commercial dynamics with 65 K€ of MRR (3) signed in the first quarter compared to €100K earned over the 12 months of the 2021 fiscal year

- Improvement of results expected from the first half of 2022

Energisme (FR0013399359/ Mnemonic: ALNRG), editor of the N’Gage SaaS solution for energy performance and of the Loamics platform, a PaaS solution for the big data sector, presents its 2021 results. The accounts closed on December 31, 2021 were approved by the Board of Directors on April 6, 2022. The accounts presented have been audited by the Statutory Auditors.

|

Consolidated data, French standards (in K€)(1) |

2021 |

2020 |

|

Revenues |

3,460 |

2,019 |

|

Operating expenses |

5,892 |

3,703 |

|

Operating expenses, including: |

13,803 |

10,079 |

|

Other purchases and external expenses |

4,241 |

3,180 |

|

Personnel expenses |

7,123 |

5,195 |

|

Depreciation and amortization |

2,271 |

1,583 |

|

EBITDA (2) |

– 5 658 |

– 4 520 |

|

Operating income |

-7,930 |

-6,104 |

|

Current income |

-8,433 |

-6,141 |

|

Financial income |

-503 |

-37 |

|

Net income |

-7,981 |

-5,910 |

71.3% growth in 2021 revenues

Acceleration confirmed in the second half of 2021: +106%

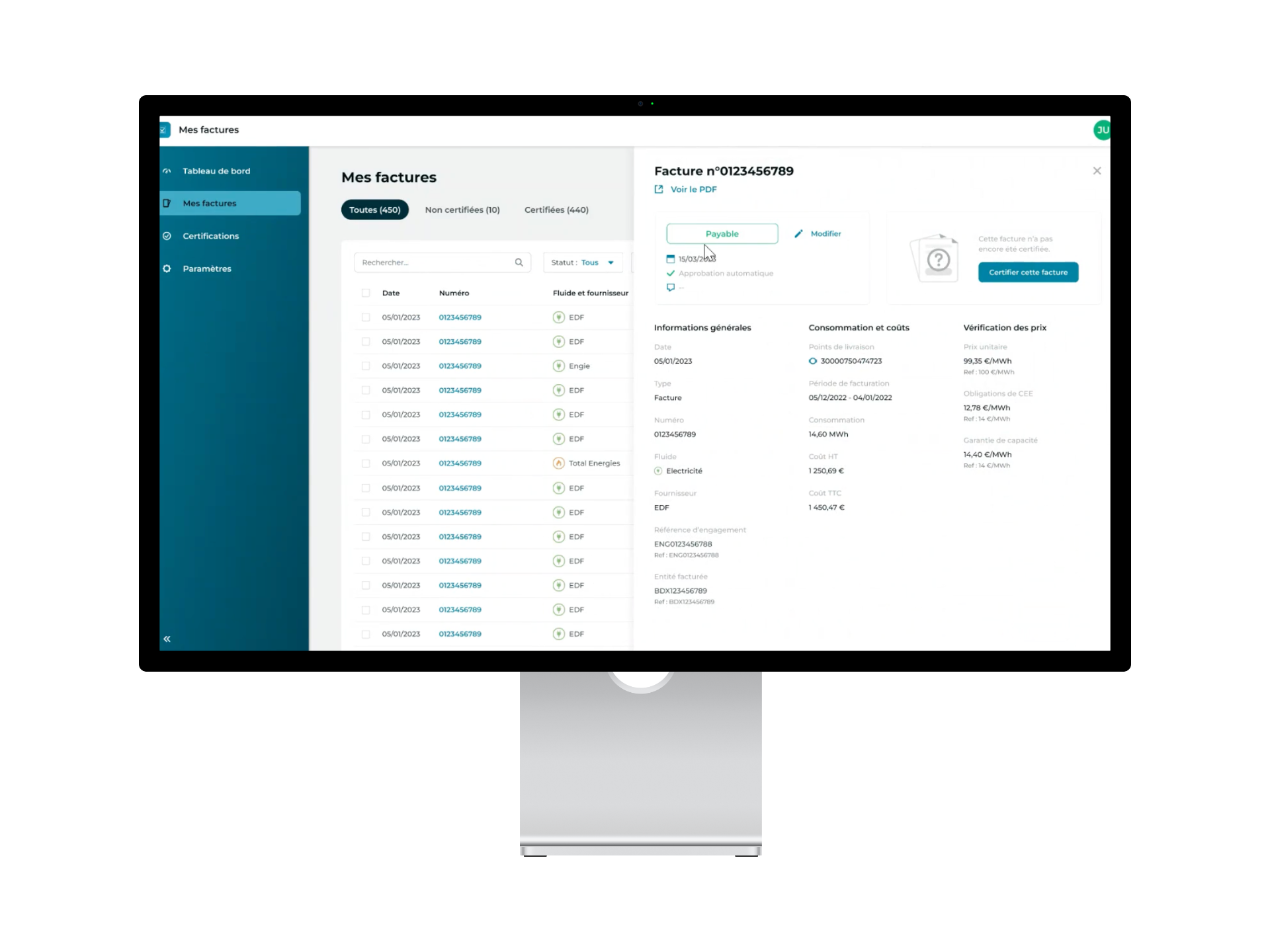

As announced, Energisme records a revenue of €3.46 million in 2021, up 71.3% compared to 2020.

After a 35% increase in the first half of 2021, the second half of the year saw a 106% increase in revenues to €2.2 million. This acceleration confirms the ramp-up of the commercial transformation, which should take full effect in 2022.

At the end of 2021, signed MRR (3) amounted to €430,000, with a strong increase compared to the end of 2020 (+30%), corresponding to a signed ARR (4) of more than €5 million.

Results that include technological investments for the Loamics platform

Technological investments were concentrated on the development of the Loamics solution with the objective of offering a big data processing platform with high-performance graphic interfaces.

The first contracts signed by Loamics, notably in the healthcare sector, and the pilots underway in industry, energy and the press, demonstrate the Group’s capacity to expand its customer portfolio.

Although these investments have temporarily weighed on the company’s accounts, they have above all enabled the company to build a technology that will enable it to assert itself in a rapidly growing market.

External expenses for 2021 amount to €4,241K.

€2,914K correspond to the use of external service providers. A rigorous plan has already been launched from the end of 2021 to reduce this amount by 40% by the end of 2022.

€1,651K correspond to non-recurring expenses. Among these, €771K are related to R&D tests with Microsoft, Amazon Web Services (AWS), and the French company Scaleway, allowing greater accessibility of Loamics on the market. Other non-recurring items include the use of subcontractors for an amount of €880K.

As announced in early 2021, investments made to accelerate business development

Personnel costs amounted to €7,123K. At the end of December 2021, Energisme had 83 employees compared to 93 at mid-2021 and 68 at the end of December 2020, with the increase mainly in sales and marketing profiles recruited to accelerate the commercial transformation.

In total, EBITDA(2) is negative at €5,658K versus €4,520K in 2020. The operating result shows a loss of €7,930K versus a loss of €6,104K in 2020.

The net result is a loss of €7,980 K.

At the end of December 2021, medium and long-term financial debt amounted to €3,432K. At the beginning of the year, thanks to amicable agreements with our main suppliers, this financial debt was increased by the financial restructuring of supplier debts in the amount of approximately €2,000K. As a reminder, in January 2022, Energisme set up a 24-month flexible equity financing line for a maximum total amount of €10 million through the issuance of bonds redeemable in new shares.

An investment that is already bearing fruit in Q1 2022: more than €65K of MRR signed in Q1. Results expected to improve significantly in the first half of the year

Energisme is fully confident in its ability to accelerate its commercial transformation in line with its strategic roadmap.

In the first three months of the year 2022, €65K of MROs have been signed, representing 65% of the amount earned over the entire 2021 fiscal year. This very encouraging performance brings the on-board ARR(4) at the end of Q1 2022 to €6M, i.e. €1M of additional ARR(4). This important performance is fully in line with the “AMBITION 20-24” roadmap unveiled on February 10, 2022.

After this first quarter in line with expectations, the group expects a second quarter that will also be very dynamic in a context where demand will be sustained by the increase in energy prices and discussions with several customers for offer extensions.

The network of marketing partners is also growing, with N’Gage and Loamics solutions being increasingly integrated into their customer offerings. The expansion of this network will continue over the next few months.

All these elements allow Energisme to be confident about the growth of the current year. This growth will be accompanied by a significant improvement in results. Indeed, in addition to the increase in the level of activity, efforts to optimize external services and personnel costs will lead to a tangible reduction in losses in 2022 compared to 2021.

Confirmation of the objectives of the “AMBITION 20-24” strategic plan

In view of these favourable developments, Energisme fully confirms all the objectives set out in its strategic plan “AMBITION 20-24”.

As a reminder, by 2024 the group has set a target of €20 million in ARR.

This revenue growth, combined with tight control of current expenses, will lead to an improvement in results from 2022 onwards, with the aim of achieving a positive EBITDA(2) by the first half of 2023. After this initial stage, the momentum of margin appreciation will enable the company to achieve a double-digit EBITDA(2) rate as early as 2024.

- K€ or in thousands of euros

- EBITDA: Operating income adjusted for depreciation and amortization. EBITDA rate: EBITDA / revenues in %

- MRR: Monthly Reccurring Revenue

- ARR : Annual Recurring Revenues or annual recurring revenue under the subscription model applied to each of the Group’s two offering

ABOUT ENERGISM

ENERGISME has developed a SaaS software solution (N’Gage) aimed at accelerating the energy performance of companies (energy service providers, energy suppliers and distributors, industrialists and property managers) thanks to data intelligence, as well as a PaaS platform (Loamics) dedicated to real-time processing of massive and heterogeneous data. Thanks to the decisive technological and operational advantages of its platform, ENERGISME has built up a loyal following of large accounts. The solution is also marketed by leading players under white label. ENERGISME (ISIN Code: FR0013399359/ Mnemonic: ALNRG) has been listed since July 2020 on the Euronext Growth market.

ENERGISME is a company eligible for the PEA-PME and is also qualified as a BPI Innovative Company and BPI Excellence.

More information: Investors – Energisme

Contacts

|

ENERGISME

Sandrine Cauvin Tel. +33 (1) 81 89 33 90 |

|

Press Relations

Jennifer Jullia Tel. +33 (1) 56 88 11 19 |

|

Investors Relations

Stephane Ruiz Tel. +33 (1) 56 88 11 26 |